[ad_1]

Law enforcement said if customers act fast, they can usually help recover the money. But not everyone is so lucky.

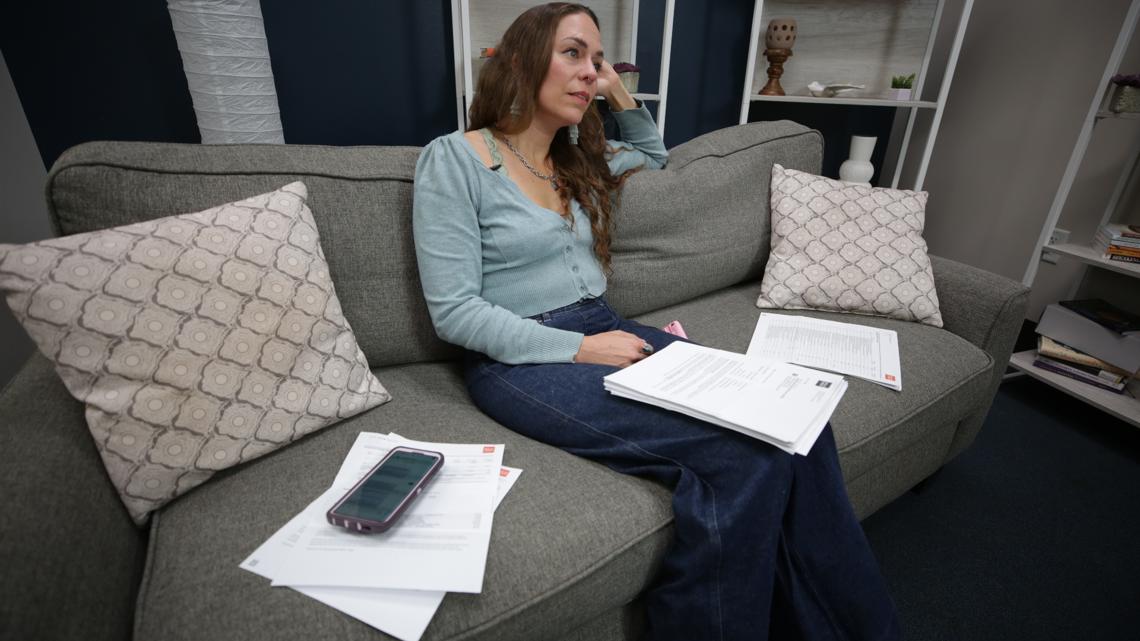

LONGMONT, Colo. — Scammers are only getting smarter, and they’re finding vulnerabilities in people who think they have their guard up. A Colorado woman thought she knew how to protect herself. But when she got tricked, then struggled to get her bank to help her fix it, she turned to Steve On Your Side.

“I’ve been a customer of Wells Fargo since I was 12. I’m 1730348728 40. It’s been a long time,” said Melanie Sponselee, who lives in Longmont. “I have a savings account with them, a personal checking account and a business account.”

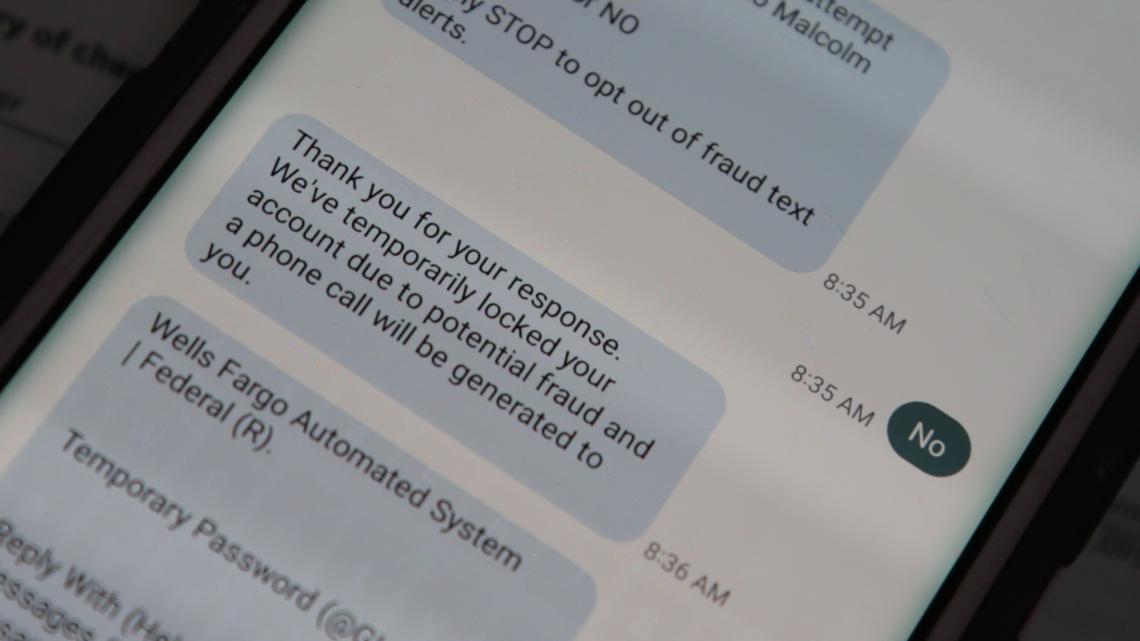

Sponselee said the trouble started this past July, with an early morning text message from what appeared to be her bank.

“I got a text – like, before 8 am. Which I’ve received before, I’ve gotten these before, saying there’s been suspicious activity,” she said. “‘There was a charge, did you initiate that charge?’ And I said ‘no.’ And I’ve received those from Wells Fargo before. I was like, ok, it’s another one of those.”

The text was followed by a phone call. Sponselee said everything seemed pretty legitimate.

“They were like, ‘Ok, so your accounts have been accessed and they have been compromised. So, I’m going to help you close your accounts and open up new ones. And I’m here to help with that. Here’s my employee number, my badge number,’” she remembered.

“I was like – they’re on it. Cool, they’re on it,” Sponselee said. “The man I was speaking with was super professional. I did not doubt it was Wells Fargo.”

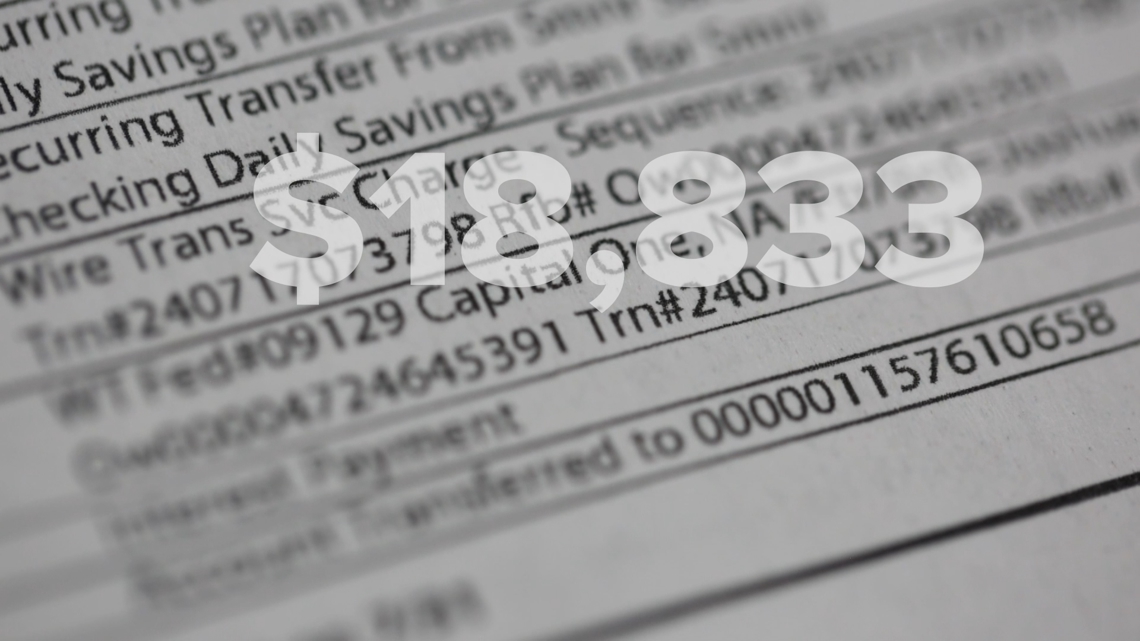

Sponselee said they provided employee identification, sounded very professional, and even used “hold music” that sounded just like Wells Fargo representatives she’d spoken with before. So, she stayed on the phone, and following their directions, she transferred almost $19,000 out of three different accounts and into – what she believed – were new and safer ones.

But then something changed.

The call got disconnected, that’s the thing that got me,” she said. “I was like, ‘Oh no, I got disconnected from these people. Where is my money?’”

“The scammers are trying to instill fear and get you to act quickly,” said Brian Blauser, an FBI Special Agent in Denver specializing in Complex Financial Crimes. “If anybody is ever asking you to transfer money out of your bank account, that is a massive red flag.”

The FBI calls these scams “phantom hackers,” where the bad guys pose as your bank, or a government institution, claiming they’re trying to help you. Instead, they’re trying to trick you into sending them money, under the guise of a wire transfer or opening a new account.

“Unfortunately, fraud is on the rise, and we are seeing drastically much higher numbers,” Blauser said, referencing both phantom hacker scams and others. “Overall fraudulent proceeds going out the door has definitely increased to the tune [of] last year where it was, like, $12.5 billion in reported losses alone.”

What can be done about “phantom hacker” scams?

There is some good news. Usually, Blauser law enforcement or a bank can help stop it.

“If we get it within 72 hours, there is a high chance that we can affect the potential freezing of those funds or the bank freezing of the funds,” he said.

If it happens to you – the FBI says move as fast as possible:

- Find and call your bank’s fraud department and tell them to initiate a wire recall (phone numbers are often on the back of your card or on your bank statement.)

- Flag the FBI through the Internet Crime Complaint Center at ic3.gov.

“That will generate stuff in the background that will take place in an effort for us to try to freeze those funds or advise a bank that a fraudulent wire has taken place,” Blauser said. “If we receive the information within 72 hours of the actual wire taking place, we do have a high rate of success. Certainly not 100% by any means. I think right now our statistical reporting is around 70% of recovery rate. That means 30% of the time we aren’t able to do anything with it because the bad guy, the scammers, have moved the funds quickly or they moved it overseas where we have less ability to do such.”

As soon as she realized it was a scam, Sponselee says she moved fast, too, hoping she could get her money back.

“There’s a branch down the street from my house. I got on the phone, got in my car, five minutes later after I got off the phone, I walked into the branch,” she said. “They were like – oh, I’m sorry. We don’t have an appointment until 1pm.”

“Also, on the way to Wells Fargo, I called the bank five times, and every time I tried to ask for help the call kept getting dropped. That happened six times.”

Despite her hustle to Wells Fargo, Sponselee was out of luck. She is just as frustrated with the bank as she is with the scammers.

“My expectations would have been, when I asked for help, to immediately help me. Immediately. Take it seriously,” she said. “And also, that they would protect me, that they would back me up. They would fix it.”

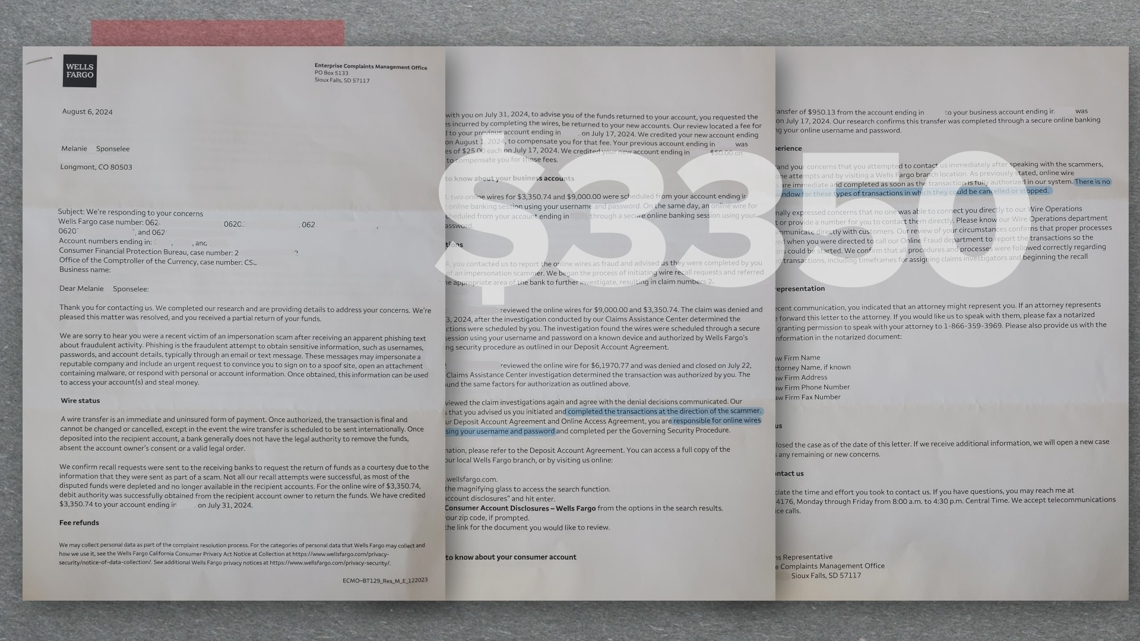

In a follow up letter to Sponselee, after she filed a complaint against Wells Fargo, the bank told her she was “responsible for online wires that originate using your username and password,” though acknowledging she told them she did so “at the direction of the scammer.”

Wells Fargo told her “a wire transfer is an immediate and uninsured form of payment. Once authorized, the transaction is final and cannot be changed or canceled.”

The bank told her they made recall requests to the banks that received her fraudulent transfers but could only get back about $3,300.

In response to Sponselee’s complaints about Wells Fargo customer service, the bank told her:

“… Our Wire Operations department does not communicate directly with customers. Our review of our circumstances confirms that proper processes were followed when you were directed to call our Online Fraud department to report the transactions so the investigations could be started. WE confirm all procedures and processes were followed correctly regarding the disputed transactions, including the timeframes for assigning claims investigators and beginning the recall process.”

“They did nothing. Nothing. I’m just out $16,000,” Sponselee said.

So now she’s moving on to a new bank, and she hopes her story can serve as a warning.

“Frauds are getting deeper and deeper and more complex. Consumers are going to continue to lose confidence in being protected from this kind of stuff,” she said.

9NEWS reached out to Wells Fargo, which did not answer any specific questions about Sponselee’s case. The bank reiterated that wire transfers are typically irreversible, even if a customer quickly reports a scammer. The bank shared the following information and tips about avoiding scams:

- Be wary of unexpected calls, texts, social media posts, or emails from scammers impersonating banks, tech support companies and government agencies.

- Don’t trust caller ID. Scammers can “spoof” legitimate numbers.

- Don’t be pressured or rushed into making a transaction.

- Don’t share personal information. Never give our passwords, PIN numbers or access codes. We won’t call and ask for those.

- Don’t be afraid to end communication with the person who contacted you and take time to research.

If you have a consumer problem, contact the Steve On Your Side team.

[ad_2]

Source link